Running a business in Australia means navigating a workplace system built on awards, pay rules, and compliance obligations. For many managers, this can feel like a full-time job in itself. Awards are dense documents filled with legal language, penalty rates, overtime rules, and complex entitlements that change depending on the role, the hours worked, and even the day of the week.

The reality is, most small to medium businesses don’t have a dedicated HR or legal department on hand to answer every compliance question. Instead, owners and managers are left trying to interpret awards themselves, often under time pressure and without complete confidence. That’s where Workwise AI changes the game.

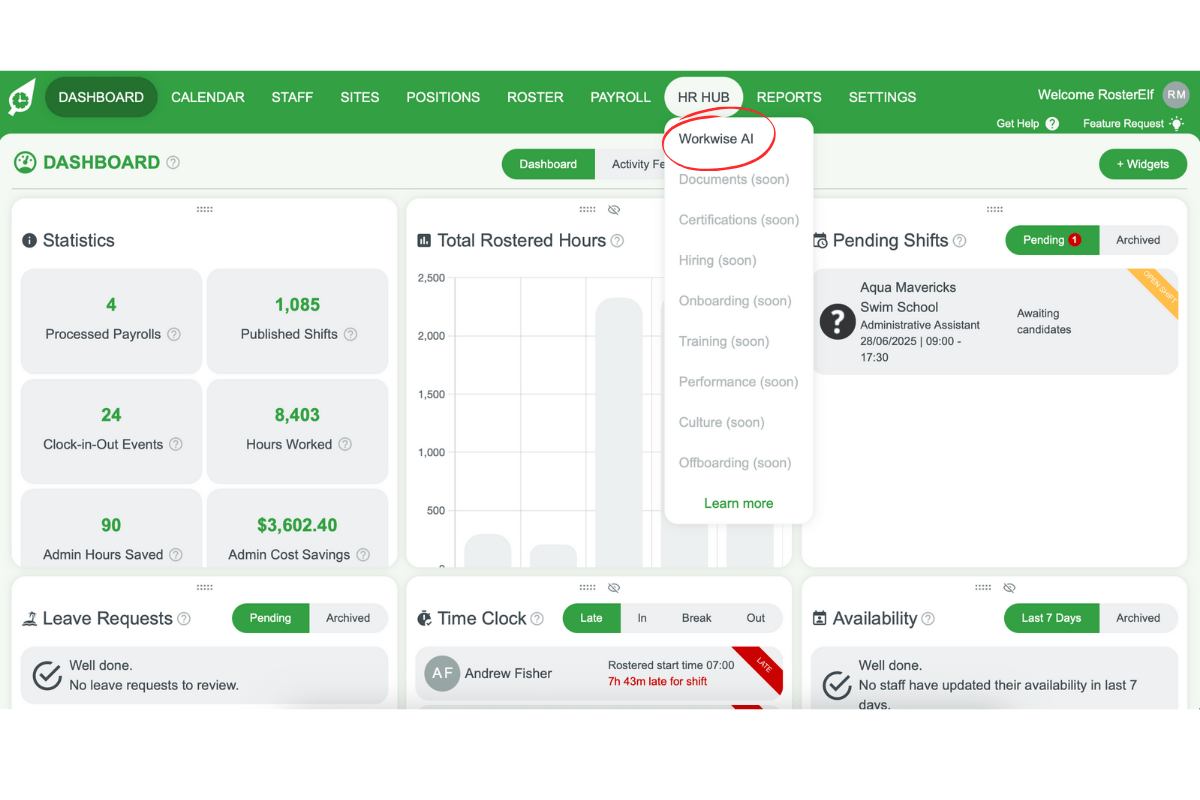

Simplifying Award ComplexityThe AI Award Interpretation Tool, built into RosterElf’s Workwise AI, is designed to take the confusion out of compliance. Instead of spending hours flipping through long award documents, managers can ask plain-language questions and get instant, easy-to-understand answers.

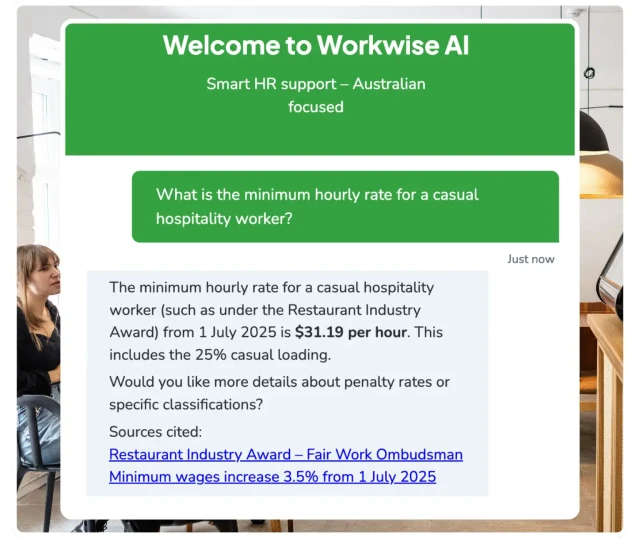

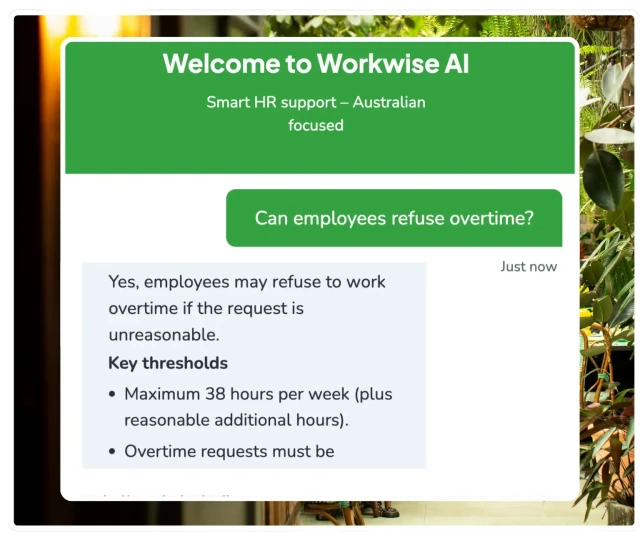

Want to know the minimum shift length for a casual hospitality worker? Need clarity on penalty rates for Sundays or overtime after 38 hours? Workwise AI gives you the answer in seconds, explained clearly so you can make confident decisions on the spot.

This means no more guesswork, no more double-handling payroll, and no more worrying that a small error might snowball into a costly compliance issue.

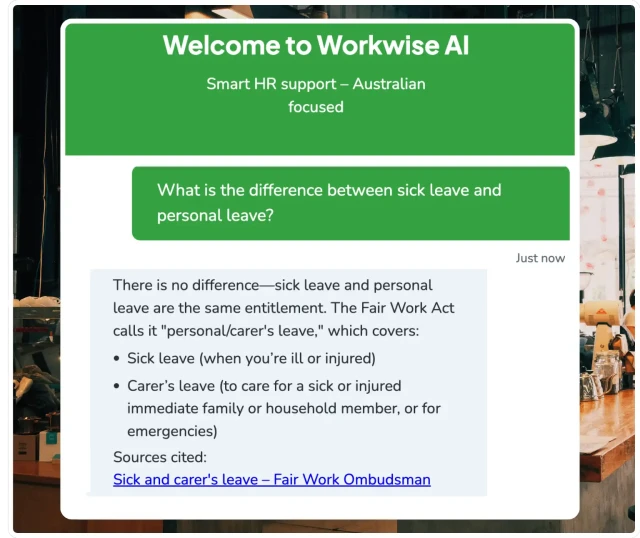

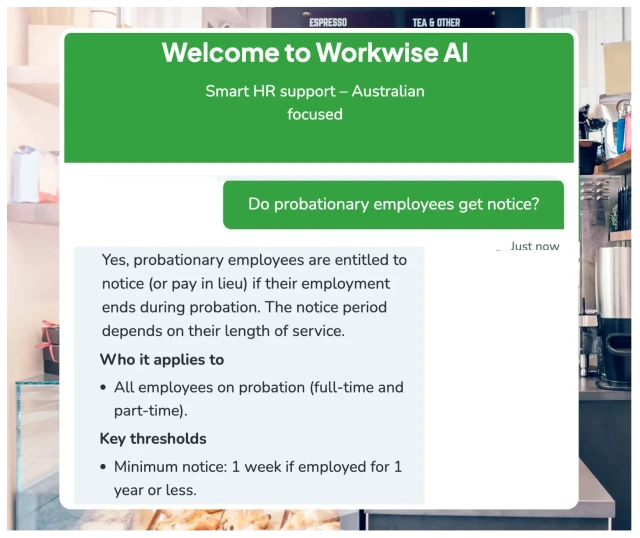

Quick, Reliable Answers for Managers and StaffWorkwise AI isn’t just for managers — employees also benefit from transparent guidance on their rights and entitlements. With award rules broken down into plain English, staff can better understand how their pay is calculated, when they’re entitled to overtime, and what breaks they should receive.

This transparency builds trust, reduces workplace disputes, and ensures everyone is on the same page.

Protecting Your Business from RiskUnderpayment cases make headlines regularly, and the Fair Work Ombudsman has made clear that “I didn’t understand the award” is not a defence. For businesses, the risks include heavy fines, reputational damage, and disputes that can drain time and money.

By providing instant guidance, the AI Award Interpretation Tool reduces the risk of payroll errors, underpayments, and non-compliance. Every answer is backed by trusted resources, helping you stay on the right side of Fair Work requirements.

Linked to Official ResourcesWhile Workwise AI gives you quick answers, sometimes you need to go deeper. That’s why every response can link you directly to the

Fair Work Ombudsman or other official government resources. This means you’re not just getting AI-powered insights — you’re getting access to the exact regulations and standards that underpin them.

It’s the perfect blend of speed, convenience, and authority.

Confidence in Every Decision

Compliance doesn’t need to be complicated. With Workwise AI’s Award Interpretation Tool, you’ll always know the right rate, the right rule, and the right way forward. It’s fast, accurate, and built to give businesses peace of mind while saving valuable time.

No more guesswork. No more stress. Just compliance made simple.

Smart, Accessible Guidance

Smart, Accessible Guidance