The best payroll option for your small business

It can be tricky to pick the best payroll for small businesses that best meet your needs, given the variety of options available. You may feel overwhelmed by all the choices, which include deciding between internal payroll and outsourcing and considering what features you'll need.

A poorly handled payroll will cause you trouble in the future. To avoid this dilemma, read this post to better grasp what each type of online payroll service can offer you and your business.

Internal payroll

When you process payroll for a small business internally, you have complete control over all payroll-related activities and can see exactly where your money is going. Basically, in-house payroll is when a company hires a team of internal employees to handle payroll for your small business.

In other words, your company's payroll department will manage every procedure step—from preparation and confirmation to submission. The HR or finance departments often house the payroll staff.

Here are some more advantages of in-house payroll in addition to having more control:

-

Customisable special boxes for tax slips

In addition to being adaptable, a reliable system for in-house payroll will cover all business situations. This calls for fresh profits for new boxes or tax slips to employees who use particular boxes. For many organisations with complex requirements, the possibility of special boxes is crucial.

Moreover, it's not an all-around situation since a solid in-house solution should be adaptable to your requirements.

-

Standardised CRA remittances

An in-house payroll system helps you balance your CRA remittances by controlling your deposits, remittances, and programs. Your in-house team can compare remittances of what was sent vs what should have been submitted after gathering all payroll data. Such remittances will indicate if the T4 summary and all employee box details are balanced.

-

Remittances

Remittances can be troublesome to submit when you have to deliver them to a third-party provider that wants them the day before. An internal online payroll system allows you to self-submit remittances without worrying about doing so soon.

You often have to wait until the next pay period to fix any adjustments you need to make with an external payroll provider. As long as the payment is made before the CRA's stated due date, an in-house payroll provider can run an off-cycle pay adjustment to address any inconsistencies, remitting the right amounts.

You can set up automated reminders and alerts to ensure you don't forget to make payments.

Outsourcing

You may outsource payroll processing to accountants and specialists with adequate training to free up your time for other work-related obligations.

When your rostering and payroll software is set up, experts will act as an extension of your company. They're experts in handling all payroll processing and reporting duties, including tax deductions, meeting all remittance deadlines, preparing year-end payroll, and answering employee payroll-related queries.

Nevertheless, your employer is still responsible for ensuring that timesheets and pertinent personnel information are sent on time to the outsourced team. You can evaluate payroll costs for a pay cycle when you outsource payroll, and you can check reports to see how much labour you use as per reports.

Software solutions

Check out some of the key rostering and payroll software functions that will improve your operation:

-

Time tracking management

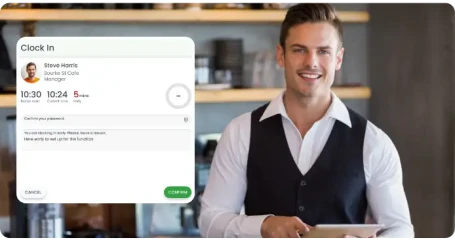

A flexible payroll time tracking system is essential since businesses can operate anytime. With RosterElf rostering and payroll software, your company can:

- Track mileage automatically for simple tax filing, reimbursements, and deductions.

- Through RosterElf software, you can easily track, submit, and approve employee time.

- Simultaneously manage several timesheets.

-

Filing taxes

Tax filing is vital to running a successful business, so superior payroll systems include tax filing features.

Using rostering and payroll software to calculate taxes would reduce the likelihood of errors and prevent penalties from the federal or provincial government, as manual calculations take time and are prone to error.

-

Compensation for employees

Payroll administration alone is a far cry from the proper management of employee compensation.

Since compensation management features handle worker's compensation, minimum-wage changes, and bonuses, you must pay attention to unusual payment methods. Such a feature gives your business an additional level of security by assuring those atypical payment methods are handled.

-

Reporting

Rostering and payroll software is no different from most company applications because it has reporting functions. Reporting is an essential tool for businesses, giving information about payroll costs.

Payroll reporting offers a thorough picture of the company's finances, taxes, employees' compensation, and insurance, among other metrics. This tool highlights trends that HR and accounting can utilise to streamline processes and eliminate inefficiency.

Reporting can be beneficial when your payroll software allows you to integrate with other applications or software.

Final thoughts

Within 40% of the payroll administrator function, according to research, could be automated over the next 5 to 7 years. The reason for this is that handling the payroll process through automation is simply quicker and more effective.

RosterElf automates financial operations and more to help streamline payroll processing for all types of industries. So, let's boost your productivity and reinvest more time in your business where it's most needed. Try the payroll and rostering software from RosterElf now.

RosterElf: rostering made easy

RosterElf's cloud-based rostering and payroll software truly is a game-changer. Say goodbye to roster conflicts and chase employees for their availability to work. Instead, employees can easily update their availability to work and notify managers about it through a smartphone app.

Staff set the times and days they can work, and RosterElf does the rest. Our software then automatically suggests available employees fill shifts.

What are you waiting for? Time to take your rostering and payroll game to the next level and boost your business' performance. Contact us now, and our team will be more than happy to assist you.

To get a clearer view of how our app works, enjoy 30-day access to our tool for free!