Tips on how to save your small business from going under

In a tight economic situation, managing a small business can be tricky. Unfortunately, there is no fixed strategy to follow to get through it. Each small business is unique and has its risks and benefits.

It is unreasonable to mimic the turnaround approach of another company simply because of these distinctions. However, there are some broad guidelines that company owners can follow, so as not to falter, and save themselves.

If you adopt a turnaround strategy, this unforeseen predicament shouldn't be the end of the road for small businesses like yours. Core turnaround strategies provide a plan for recovery under pressure.

Here, we outline the essential steps and strategies you can use to prevent your small business from flopping.

Don't compromise on quality

Managing expenses is essential in challenging times. Owners must continue to be proactive in convincing employees to accept changes. However, keep in mind that quality should not be compromised when making these product improvements.

Avoid making drastic changes to critical parts if you want to increase your profit margins. For instance, a pizzeria owner can try to boost margins per slice if the business is slow by buying cheaper ingredients.

Be wary that the strategy can backfire if people dislike it and sales drop. The secret is to reduce costs and expenses without sacrificing the final product's quality. Instead, look for ways to cut the price of paper napkins or takeout boxes.

Take a broad perspective

We sometimes strike the most apparent issues with agility and no shilly-shallying. That makes it reasonable and can even be wise from a commercial standpoint in some circumstances.

It is also a good idea to take a step back and consider the bigger picture to determine what is still effective and what might need to change. It's an opportunity to understand better the scale and extent of current issues and your company's business strategy. This includes how its strengths and weaknesses are put into action.

For instance, let's say a small business owner learns that two employees are routinely overstocking or understocking particular items due to some mistakes they make with the inventory. While it could be tempting to terminate such workers right once, it's better to assess if the manager who hired and supervised them provided adequate training.

If the management is at fault, you can fire them, although this might not be the wisest course of action. The manager is probably someone you want to maintain if their relationships with current customers have a record of generating repeat sales and significant revenue. Instead of firing someone, retraining them could be ideal.

Do an inventory with your team

Making sure that money is used wisely makes sense, as payroll is often one of a small business owner's most significant expenses. To ensure that the right individuals are on board and performing their roles effectively, this includes a thorough assessment of the employees, both when a problem arises and during regular company operations.

You're just making poor financial decisions when you hire the cheapest workers. Remember that there are occasions when the employees' productivity is the main culprit.

It's logical to hire one employee who is 20% more expensive than the average employee yet is 40% more productive. Business owners can hire new workers as necessary to boost productivity by actively searching resumes and conducting interviews with new applicants.

Be keen about little things

While keeping an eye on the large picture is crucial, you shouldn't turn a blind eye to small things that can potentially affect your business operation. Minor issues can greatly impact a company's bottom line, such as inadequate parking, poor access to the road or traffic, and inefficient advertising.

Consider and analyse the numerous factors that bring clients in the door to discover specific issues. It could also be beneficial to go through your quarterly spending section. The items in question probably cost necessary, so you shouldn't be looking for one-time expenses here.

Instead, keep an eye out for small things that seem harmless but are draining your funds. For instance, if office supplies are bought wrongly, the cost can quickly spiral out of control. Similar to this, if your supplier raises the price of their goods, you should think about finding another, less expensive source.

Make sure you have cash access

Specifically, during moments of crisis, small business owners like you should take measures to ensure that your company has access to funds. A smart first step is to speak with a bank loan officer and learn what is required to obtain a loan.

Not just that, it's also wise to arrange a line of credit in advance to cover potential short-term funds issues. For a small business, forming a positive working relationship with a lender is always beneficial. Don't forget to prepare other possible sources of capital, too.

This could involve using funds, selling shares, or borrowing from family and friends. To get through tough times, you must have access to finance or find innovative ways to raise and save money.

Can a small business survive in a downturn?

In a depressed economy, a small business can indeed survive. Still, it all depends on the company, how it's set up, what industry it operates in, and if it has the flexibility to make the necessary changes to maintain profitability.

Final thoughts

It's crucial to keep your calm when things go rough for your small business more than before. When you are stressed or preoccupied with minor issues, it's easy to miss a simple remedy that could keep your business afloat. During a difficult time, your top goals should be to keep the broad picture in mind and ensure that you and your employees are doing things effectively.

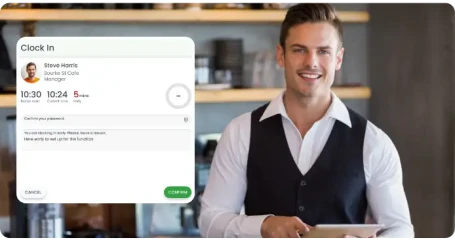

RosterElf: Rostering made easy

RosterElf's cloud-based payroll and rostering software truly is a game-changer. Say goodbye to roster conflicts and chase employees for their availability to work. Instead, employees can easily update their availability to work and notify managers about it through a smartphone app.

Staff set the times and days they can work, and RosterElf does the rest. Our software then automatically suggests available employees to fill shifts.

What are you waiting for? Time to take your rostering and payroll game to the next level and boost your business' performance. Call us now, and our team will be more than happy to assist you.

To get a clearer view of how our app works, enjoy 30-day access to our tool for free!